- Ethereum plummeted nearly 5% after the NFP missed expectations in August.

- Based on AUM to market cap ratio, the Ethereum ETF performed roughly in line with the Bitcoin ETF one month after launch.

- To keep the bullish thesis going, ETH needs to bounce back around $2,100.

Ethereum (ETH) fell roughly 5% on Friday after the U.S. released worrying August non-farm payrolls (NFP) data, while JPMorgan analysts published a report stating that the ETH ETF performed similarly to the Bitcoin ETF one month after its launch.

Daily Digest Market Trends: Ethereum Drops, JP Morgan Shares Hit by ETH ETF

Ethereum, along with the broader cryptocurrency market, is now on track for a third consecutive day of declines following a further sharp drop on Friday. The drop came after the release of U.S. Non-Farm Payroll (NFP) data for August, which showed that the unemployment rate fell to 4.2% from 4.3% in July and the U.S. economy added 142,000 jobs.

The US employment report spooked the US market as Wall Street had expected at least 160,000 new jobs and the figure comes after a slowdown in hiring in July. Along with US stocks, Ethereum fell after showing signs of recovery during the European trading session.

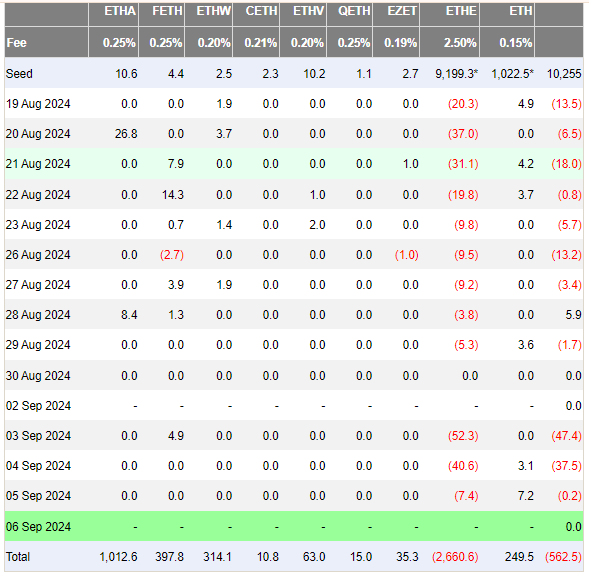

A similar trend was seen across Ethereum exchange-traded funds (ETFs), which saw negative inflows for a third straight day, according to data from Far Side Investors, with the product seeing net outflows of $200,000, the lowest outflows since its launch.

The ETH ETF’s poor performance is evident when comparing inflow and outflow days. Notably, since inception, the ETH ETF has had only 9 days with inflows, 23 days with outflows, and 1 day with zero inflows. Cumulative inflows have been a net outflow of $560 million.

ETH ETF Flows

While some market participants believe the ETH ETF’s performance has fallen short of expectations, analysts at JP Morgan said the ETH ETF’s performance is roughly on par with the Bitcoin ETF. Comparing assets under management (AUM) as a percentage of market capitalization one month after launch, the analysts said the two products are roughly comparable.

“We estimate that as of the end of August, the ETH ETFs’ group of total assets under management (including Grayscale’s ETHE) represented approximately 2.3% of Ethereum’s total market cap,” the JPMorgan analysts wrote. “By comparison, on the spot Bitcoin ETF’s 29th day of trading (22 February 2024), the BTC ETFs’ total assets under management (including Grayscale’s GBTC) represented 3.0% of Bitcoin’s total market cap at that time,” they added.

The ETH ETF’s assets under management match its percentage of Bitcoin’s equivalent token market capitalization approximately one month after launch.

“When comparing total assets under management (including legacy Grayscale products that were converted to ETFs at launch) with each token’s share of the market…— Matthew Siegel, CFA Recovering (@matthew_sigel) September 6, 2024

Meanwhile, asset management firm VanEck announced in a press release on Friday that it will close and liquidate its Ethereum Futures ETF (EFUT) after the market closes on Sept. 16. The company cited several possible reasons for the decision, but members of the crypto community have noted that it could be because VanEck has already launched a spot ETH ETF. The firm also closed its Bitcoin Futures ETF following the approval of its spot Bitcoin ETF, WuBlockchain noted.

ETH Technical Analysis: Ethereum Needs to Bounce Off Key Support to Sustain Bull Run

Ethereum was trading around $2,260 on Friday, down 4.7% from the previous day. In the past 24 hours, ETH saw $35.08 million in liquidations, with long and short liquidations reaching $26.67 million and $8.42 million, respectively.

On the daily chart, ETH is below the descending trend line within a symmetrical triangle, suggesting that the price may decline towards $2,100 in the coming weeks before rising. ETH recorded similar declines from August to November 2022 and July to October 2023 before rising.

ETH/USDT daily chart

If history repeats itself, ETH could bounce back near $2,100 and then begin an uptrend to challenge the resistance at $2,817. A successful climb above this resistance could spur ETH to further rise and potentially test the yearly high resistance near $4,093.

If the daily candle closes below the lower ascending trendline of the symmetrical triangle, ETH could head towards support around $1,540.

The Relative Strength Index (RSI) is trending down towards the oversold region at 33. The %K and %D lines of the Stochastic Oscillator are also showing a similar trend, hovering in and around the oversold region.

The Awesome Oscillator has displayed consecutive red bars below the zero line, indicating that bearish momentum is prevailing.

Ethereum FAQ

Ethereum is a decentralized, open-source blockchain with smart contract capabilities. It serves as the underlying network for the Ether (ETH) cryptocurrency, the second-largest cryptocurrency by market cap and the largest altcoin. The Ethereum network is tailored for scalability, programmability, security, and decentralization, making it popular among developers.

Ethereum uses decentralized blockchain technology, allowing developers to build and deploy applications independent of any central authority. To make this easier, the network provides a programming language that allows users to create self-executing smart contracts. Smart contracts are essentially pieces of code that are verifiable and allow transactions between users.

Staking is the process by which investors grow their portfolio by locking assets for a period of time rather than selling them. It is used by most blockchains, especially those that employ the Proof-of-Stake (PoS) mechanism, where users earn rewards as an incentive to commit tokens. For most long-term cryptocurrency holders, staking is a strategy to earn passive income from assets, leveraging them in exchange for generating rewards.

Ethereum moved from Proof of Work (PoW) to Proof of Stake (PoS) mechanism in an event named “Merge”. This transformation occurred because the network wanted to implement new scaling solutions that would improve security, reduce energy consumption by 99.95% and have a threshold of 100,000 transactions per second. PoS provides a lower barrier of entry for miners due to the reduced energy demand.

#Ethereum #Drops #August #NFP #Data #ETH #ETF #Continues #Outflows