After a remarkable boom in 2022, the hype around non-fungible tokens (NFTs) is fading, with a recent report revealing that 96% of NFT collections are now considered dead.

The researchers came to this conclusion after analysing a collection of 5,000 NFTs, tracking around 5 million transactions, and looking at metrics such as holder profitability, collection performance and project longevity.

Report: 96% of NFT projects have disappeared

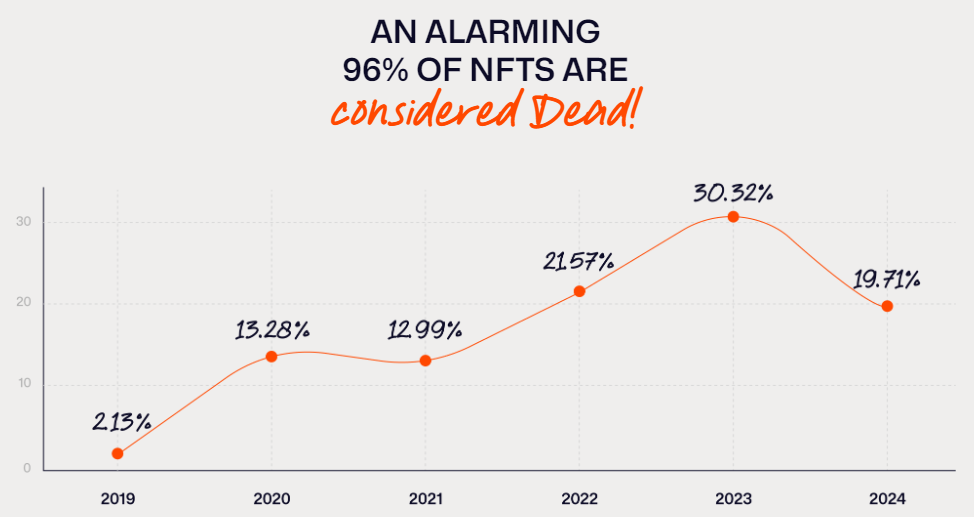

According to a survey by NFT Evening, 96% of NFT projects are considered dead, and 43% of holders are not currently making a profit. On average, NFT holders face a 44.5% loss, and the typical lifespan of an NFT is just 1.14 years, 2.5 times shorter than that of crypto projects. Notably, nearly one-third of NFT projects will “die” in 2023, marking the highest failure rate ever.

Azuki collections have been ranked as the most profitable NFT digital collectibles, with holders realizing over 2.3x ROI. Azuki’s “strong community engagement and effective marketing strategy” have driven high profitability and maintained interest and sales in the collection.

In May, BeInCrypto reported that Azuki NFT sales had soared to record highs, reaching $1.13 million in a single month, bringing total sales to over $1.12 billion. This continued success highlights the strong and enduring interest in high-value NFTs. Other popular NFT collections such as CryptoPunks and Bored Ape Yacht Club also continue to be top choices, according to data from Cryptoslam.

Read more: The 7 Best NFT Marketplaces to Know in 2024

In contrast, the Pudgy Penguins collectible has been classified as one of the “dead” projects, despite a strong performance in May. Research shows that holders of Pudgy Penguins NFTs are currently experiencing significant losses, a massive drop of 97%.

The disparity in holders’ profit and loss ratios, the gap between successful and unsuccessful collections, and the variance in project longevity indicate that the NFT market is no longer the money tree it once seemed.

“While it’s true that the majority of PFP-style NFTs have lost value, this is natural and expected given that most were derived from a few innovative initial projects in the first place. This also applies to crypto tokens as a whole. There’s a well-known dynamic in multiple crypto market cycles where innovation and price growth attracts speculators, boosting many worthless derived tokens, which then fund development and innovation for the next cycle,” Wes Levitt, head of strategy at Theta Labs, told BeInCrypto.

Read more: 10 Best NFT Marketing Agencies to Promote Your Digital Art

Meanwhile, the Trump NFT collection continues to grow with the release of the fourth series, “America First,” and Tron founder Justin Sun announced plans to launch his own NFT project on the blockchain.

Investors should do their research carefully, as the report shows a wide variation in the performance of NFT projects. Issues such as rug pulling, where a project disappears along with investor funds, and wash trading, which fakes demand, are common in the NFT space. Additionally, the legal rules around NFTs are still unclear, posing risks for those considering entering the market.

“The PFP side of NFTs has always been speculative by its nature, but the capital flowing into the space has also supported more meaningful NFT projects. In the future, NFTs aiming for long-term value will need to benefit from owning them rather than relying on hype and speculation,” Levitt added.

Disclaimer

In accordance with the Trust Project guidelines, BeInCrypto strives for fair and transparent reporting. This news article aims to provide accurate and timely information. However, readers are encouraged to independently verify facts and consult with experts before making any decisions based on this content. Please note that our Terms of Use, Privacy Policy and Disclaimer have been updated.

#NFTs #dead #reports